Calculator

2022

Your refund or amount owed for 2022

$0

2023

Your refund or amount owed for 2023

$0

2024

Your refund or amount owed for 2024

$0

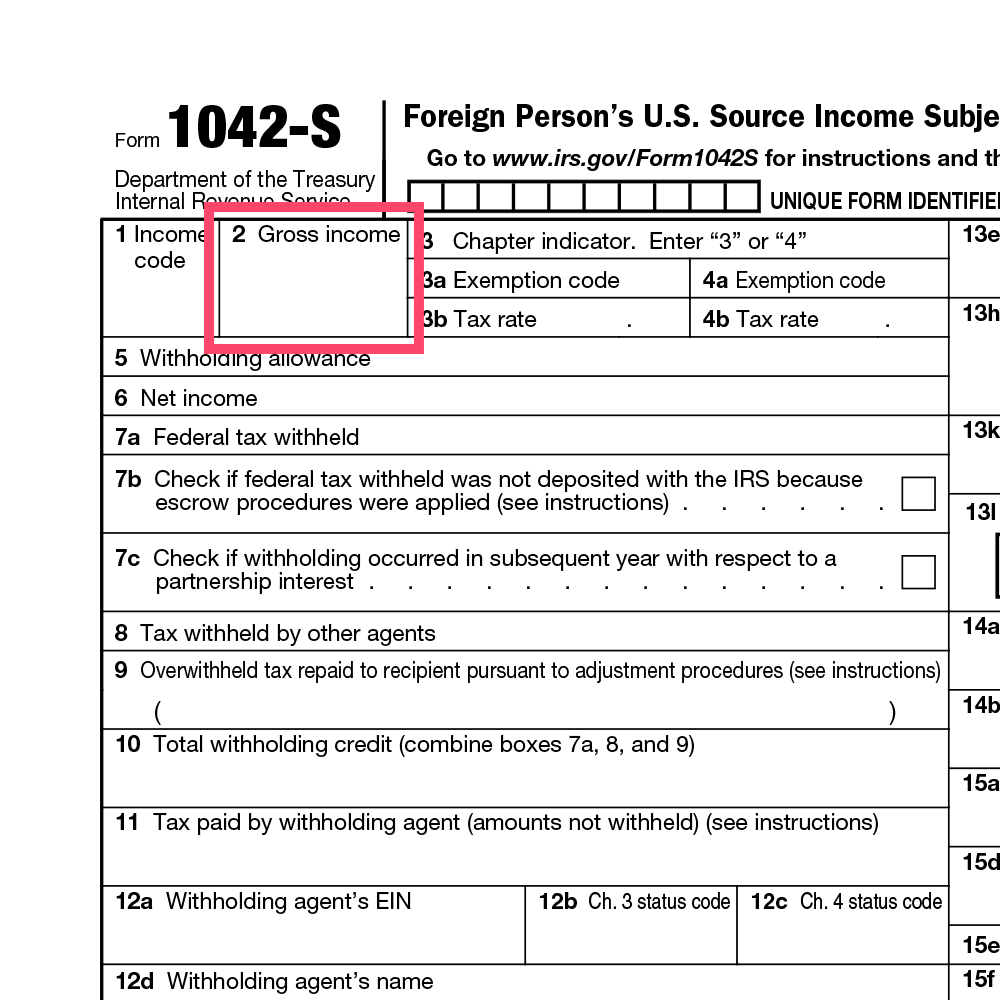

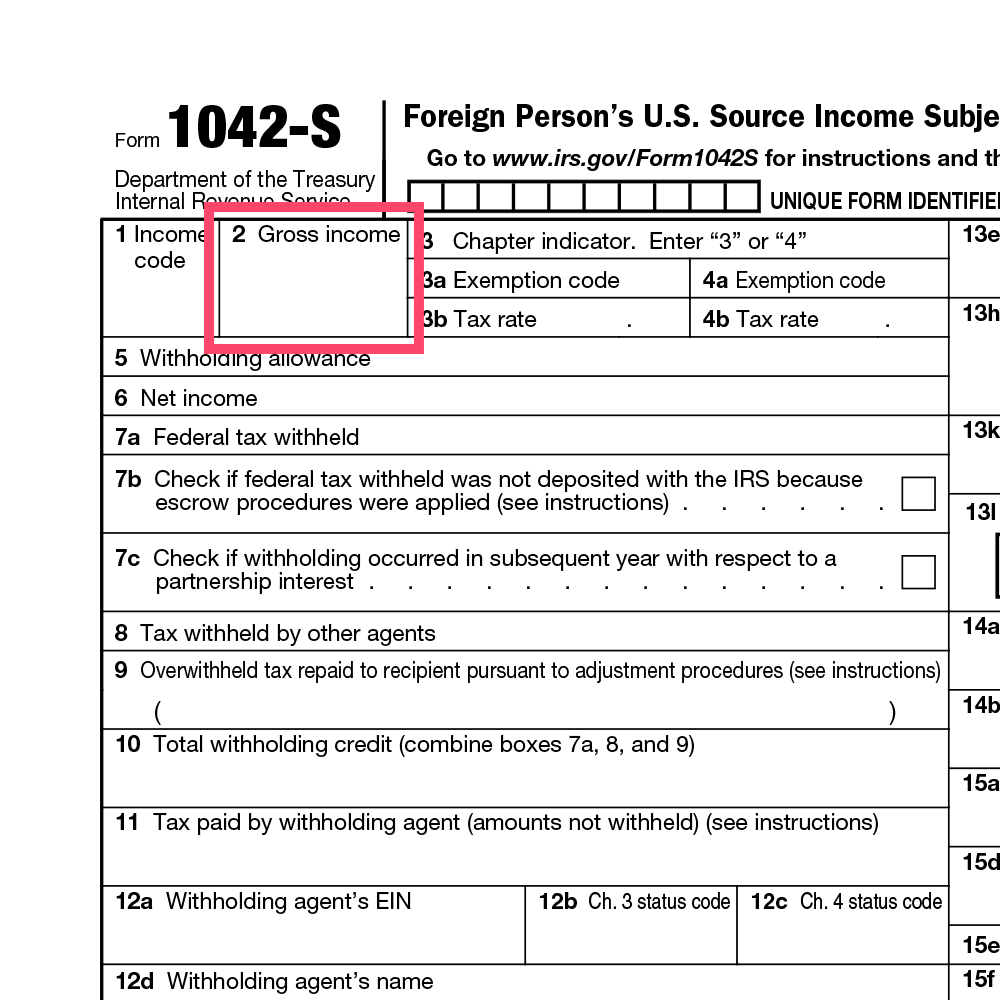

U.S. source income

Portion of gross income reported on Line 2 of Form 1042-S that was earned in tournaments that took place inside the United States.

Non U.S. source income

Portion of gross income reported on Line 2 of Form 1042-S that was earned in Europe or anywhere else outside of the United States.